Shared Equity Model Explained

While community land trusts (CLTs) often operate behind the scenes in the United States real estate world, their roots run deep. Emerging at the tail end of the Civil Rights Movement, CLTs were created as non-profit organizations dedicated to managing and stewarding real property for the public good. Today CLTs are gaining attention as creative and sustainable solutions to housing affordability challenges, attracting interest from many communities and policymakers across the country.

At their core, CLTs balance value and risk to serve a target population, promoting long-term benefits for homeowners and communities alike. Though CLTs can take many forms, the College Park Community Preservation Trust adopts a shared equity model that makes homeownership more attainable while preserving affordability for future buyers. This approach not only opens doors for those seeking to buy a home but also ensures that affordability remains a cornerstone of the community.

What is Shared Equity?

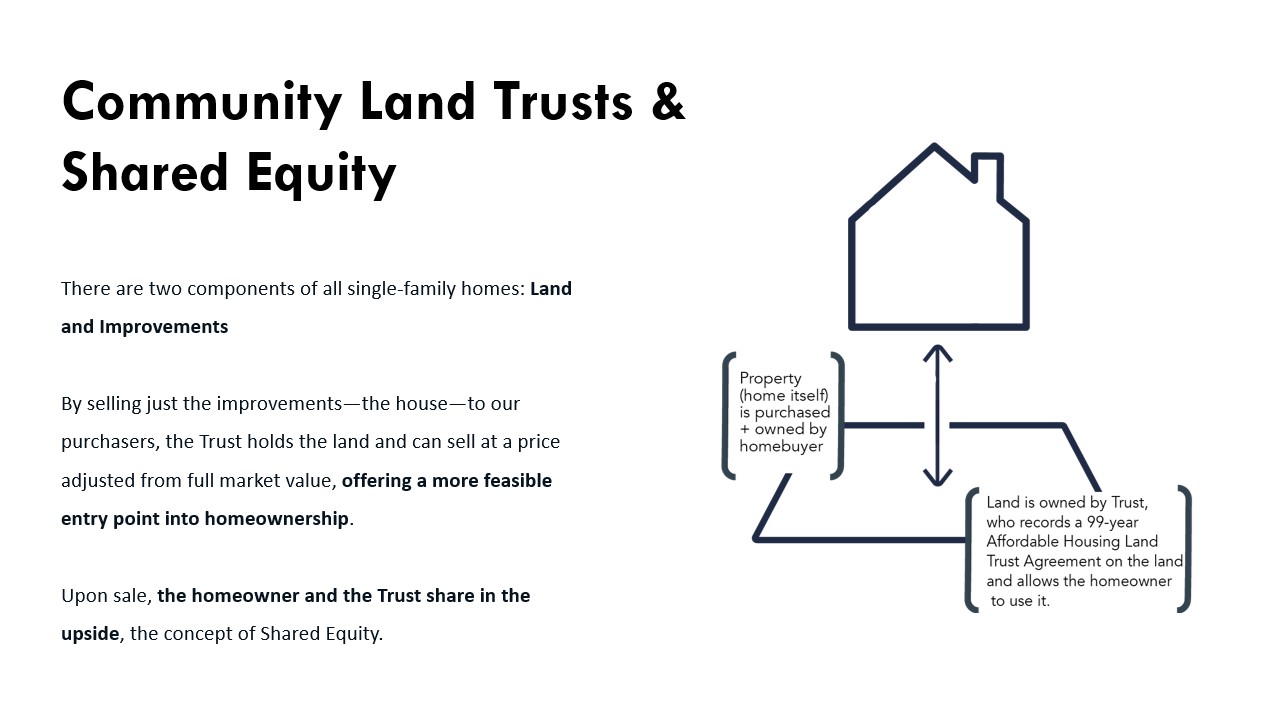

In traditional real estate transactions, the purchase price of a single-family home includes both the land and the improvements, with the buyer assuming full ownership of both components. In contrast, a shared equity model establishes a long-term partnership between the community land trust and the buyer. The trust retains ownership of the land while selling the home and its improvements to the buyer at a significantly reduced price.

During ownership, the buyer pays their mortgage and a modest land trust fee, while the trust and the buyer share in any appreciation of the property’s value over time. This separation of land and home value allows for much deeper levels of affordability. Buyers purchase only the improvements and gain the opportunity to build equity in their home while the land remains in trust.

Shared equity not only unlocks affordability for the initial buyer but also ensures the property remains affordable for future generations. When the original buyer decides to sell, the trust may exercise its right of first refusal to repurchase the home. The trust may then resell the property under the same affordability arrangement to the next buyer, perpetuating a cycle of accessible homeownership.

Shared Equity as Wealth Creation

A common concern of the shared equity model is that buyers may miss out on the full appreciation of the property’s value. However, buyers still build substantial equity in homes purchased at reduced prices and can further increase the home’s value through improvements during their period of ownership. Homeownership, even under a shared equity model, offers wealth-building opportunities that renting cannot offer. A 2010 study by the Urban Land Institute examining seven shared equity programs found sellers in nearly all programs achieved median rates of return higher than they would have earned by renting and investing their down payment in the stock market or Treasury bonds.

At its core, the shared equity model exemplifies a sustainable way to balance housing affordability with wealth-building opportunities. By stewarding land for the collective good, the Community Preservation Trust that its participants can achieve long-term homeownership without dedicating an unsustainable portion of their income to housing costs. This creative approach secures affordability and stability for College Park households now and in the future.

Read more about the Trust’s 2024 activities here. For more information about the Community Preservation Trust, visit our website.