Why We Created An Affordable Housing Land Trust

In our August issue of the Monthly Bulletin, we discussed “Why Housing Matters,” some of the core components of the state of what we see as a housing crisis in this country, how homeownership can function as a key means of wealth creation, and what tools are available to address these issues. In College Park, a city of 35,000 people, home to the University of Maryland’s flagship campus, with more than 40,000 students, is a microcosm of housing challenges in all respects—it is a city in the center of the bustling Washington metropolitan area, where there has been significant housing appreciation, limited new construction of residences, and traditional urban challenges where everyone wants the same things—access to education, transportation, services, entertainment and work (or school, as appropriate).address Addressing such challenges is a consistent and continuing area of focus for citizens and community leaders of College Park. One of the remedies identified to such challenges led to the formation of the Community Preservation Trust.

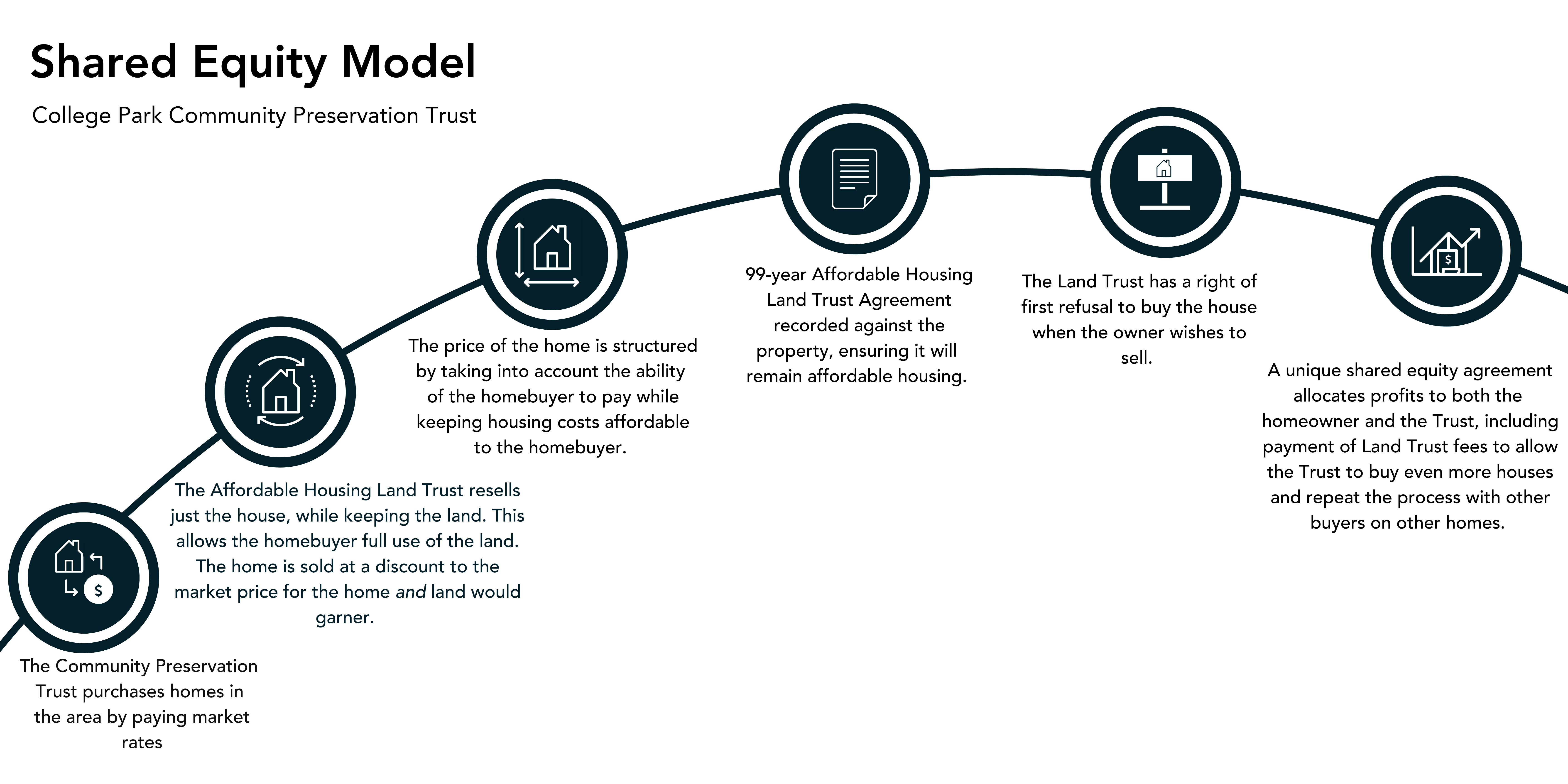

Though officially established as an Affordable Housing Land Trust in the State of Maryland in May of 2023, the College Park Community Preservation Trust’s (the Trust’s) formation is the by-product of years of research, community discussion and long-term fundraising by the College Park City- University Partnership. The Partnership was a key driver of the of the University-Community Vision 2030 (and its predecessor document, University District Vision 2020). The plan identified 4 key strategy areas of focus, including “Housing and Development.” In order to optimize the effectiveness of such a Community Preservation Trust, the Partnership established the Trust as an Affordable Housing Land Trust, consistent with the Affordable Housing Land Trust Act of 2010, now contained in the Maryland Annotated Code Real Property § 14-501. This section of the law allows the Trust to buy homes and resell them at reduced prices to people of low- and moderate incomes (up to 140% of Median Family Income), in exchange for other benefits, including:

When the total set of benefits was analyzed for the Affordable Housing Land Trust model, the College Park City-University Partnership recognized the model allowed for several complementary goals to come together:

- Increase the rate of owner-occupied homes,

- Enhance the strengths of neighborhoods,

- Provide an opportunity for people who could not afford to own a home in College Park to do so by a reduced price allowed in the Land Trust model,

- Provide an opportunity for people to sell their homes and leave their neighborhood to stewards who can create wealth that would otherwise be unavailable

- Create data to assess how the land trust model works to build equity.

To gear up for this program, the Partnership—raised nearly $15,000,000 in start-up capital from federal, state and local governments as well as non-profit funding philanthropies for these efforts. At this writing, the Trust purchased one home, bought a second –and sold it to the renter who lives there, and has a third under contract as well.

Stay tuned – we will continue to add context to this exciting initiative!